Reinhart and Rogoff Financial Modelling Error

Economists admit that there was an error in their modelling.

Error Type: Formula error

Reported on: 16th April 2013

What happened?

In 2010, economists Carmen Reinhart and Kenneth Rogoff released "Growth in a Time of Debt."

The paper controversially drew a correlation between debt and GDP stating that "median growth rates for countries with public debt over 90 percent of GDP are roughly one percent lower than otherwise; average (mean) growth rates are several percent lower."

On reviewing the data and modelling it emerged that there were three main issues with the analysis:

- Reinhart-Rogoff used a selective dataset of 1946-2009

- They applied unconventional weighting in the analysis

- There was a glaring error in their Excel-based financial model

What caused the Excel error?

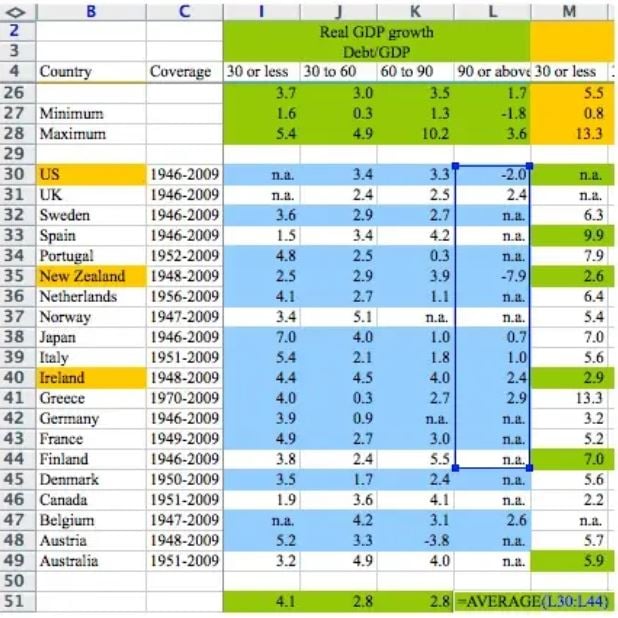

It turns out it was one of the simplest and oldest Excel errors in the book. One of the formulae didn't include all of the rows that it should have. This meant that five countries were excluded from the analysis.

This can be clearly seen below:

How could the error have been avoided?

Unfortunately this kind of financial modelling error continues to be found regularly in models.

The first step to avoiding this kind of error is ensuring that your models are well structured and built with rigorous attention to detail.

But let's face it, we are all human, and humans make mistakes. This is why it is vital to always build a review and test phase into your financial modelling build cycle.

Tools like Excel Analyzer, EXChecker, OAK, nxt, RiskHive and PerfectXL are all designed to highlight this kind of error at the click of a button. We cover all of these spreadsheet review tools within the Tech Stack in Full Stack Modeller.

Read the article published by Business Insider here.

Full Stack's Financial Modelling Errors Series

See our complete financial modelling error series here.